On 17th May 2023, the European Commission put forward proposals for the most ambitious and comprehensive reform of the EU Customs Union since its establishment in 1968. The reform responds to the current pressures under which EU Customs operates, including a huge increase in trade volumes, especially in e-commerce, a fast-growing number of EU standards that must be checked at the border, and shifting geopolitical realities and crises.

The measures proposed present a world-leading, data-driven vision for EU Customs, which will massively simplify customs processes for business, especially for the most trustworthy traders. Embracing the digital transformation, the reform will cut down on cumbersome customs procedures, replacing traditional declarations with a smarter, data-led approach to import supervision. At the same time, customs authorities will have the tools and resources they need to properly assess and stop imports which pose real risks to the EU, its citizens and its economy.

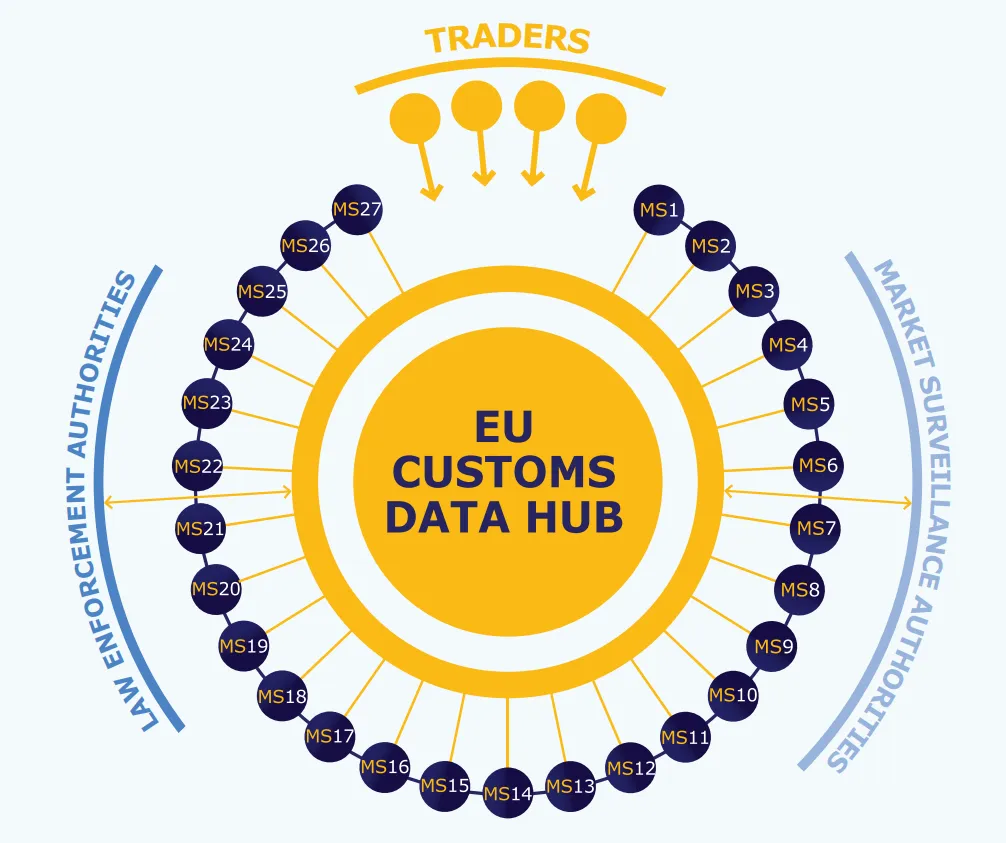

A new EU Customs Authority will oversee an EU Customs Data Hub which will act as the engine of the new system. Over time, the Data Hub will replace the existing customs IT infrastructure in EU Member States, saving them up to €2 billion a year in operating costs. The new Authority will also help deliver on an improved EU approach to risk management and customs checks.

Overall, the new framework will make EU Customs fit for a greener, more digital era and contribute to a safer and more competitive Single Market. It simplifies and rationalises customs reporting requirements for traders, for example by reducing the time needed to complete import processes and by providing one single EU interface and facilitating data re-use. In this way, it helps deliver on President von der Leyen’s aim to reduce such burdens by 25%, without undermining the related policy objectives.

The below is a press release from industry relevant trade and business representative groups in response to this latest proposal, showing support and a willingness to contribute to the work of this initiative. Among the undersigned trade and business associations are CLECAT, of whom IIFA is a National Association Member.

Trade and business representatives stand ready to work with all EU institutions to make the customs union a driver of future competitiveness for the EU

The undersigned trade and business associations, who represent European Customs Brokers and freight forwarders, the Express Delivery Sector, the American Businesses active in Europe, Global and European Shipping Lines, European and International Airlines, Cargo Owners, Ship Suppliers, Manufacturers, Retailers and Wholesalers, note the great importance of the European Commission’s proposal for a comprehensive reform of the legislative framework, the working and the governance of the EU Customs Union as published today. This coalition strongly agrees with the need to revamp the EU customs system, in order to better reflect the need for balance between trade simplification and enforcement, to ensure a cohesive and harmonized interpretation of the rules across the EU and to better equip it in order to face current global challenges and protect the Single Market.

As active members of the European Commission's Trade Contact Group (TCG), we have constantly engaged in a constructive manner to support the full implementation of the Union Customs Code (UCC) and have always recognized its essential role in sustaining compliant, effective and efficient international trade. Therefore, we are poised to work in the closest collaborative partnership with the European Commission, the European Parliament and all EU Member States to deliver a successful implementation of the UCC reform.

It will be particularly important for trade representatives to work closely with the EU Institutions during the upcoming co-decision process, as the concrete proposals tabled have not benefitted from trade consultation. Considerable industry input will be vital to ensure that the proposals become better adapted to the realities of business, trade and different transport modes bringing goods to the EU, which many currently lack. We are especially keen to ensure that the results meet the expectations and needs of a modern global customs environment for trade and we believe that an open exchange between the political, administrative, and operational parties is the only approach that can result in successful reform.

We have directly witnessed the persistent lack of simplification and uniformity in the application of customs rules and a fully electronic environment for the completion of customs formalities in the EU, which were original objectives of the UCC. In particular, the deployment of the electronic systems still faces major challenges and there is diversity of interpretation and implementation of EU customs rules between EU Member States. The current state of UCC electronic systems deployment is already negatively impacting many European businesses. We urge the Commission not to wait upon the implementation of the newly reformed UCC to address this issue that requires immediate attention.

At this stage, we would also like to draw attention to the need to ensure that an effective reform of the EU customs system is fully compatible with WTO rules and especially with the WTO Trade Facilitation Agreement (TFA). The multilateral trading system has delivered very important results with regard to the simplification, modernization and harmonization of export and import processes thanks to the TFA and its provisions. Both EU traders and EU businesses of all sizes benefit from the application of TFA rules that govern and expedite the movement, release and clearance of goods. This coalition group would like to remind all EU institutions to carefully consider this relevant aspect in the future review of the UCC reform proposal.

For further information, please see:

https://taxation-customs.ec.europa.eu/customs-4/eu-customs-reform_en